child tax credit october payments

However if you still havent received any checks or if youre missing money from one of the months. No Tax Knowledge Needed.

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

A technical issue that delayed last months payments for a small number of advance child tax credit recipients in.

. 2 days agoLots of parents found money in their checking accounts over the last few months. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Answer Simple Questions About Your Life And We Do The Rest.

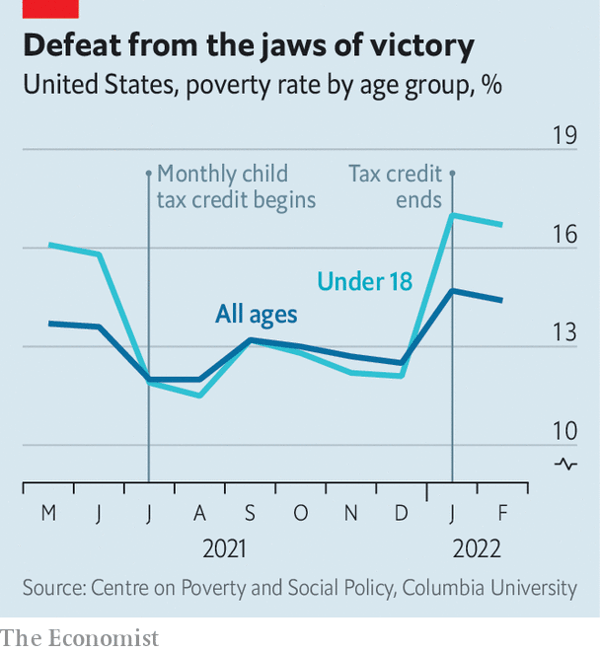

Yes even if you dont file taxes by the deadline or dont owe taxes April 18 is not the last chance to claim child tax credits or the earned income tax credit. The Child Tax Credit reached 611 million children in October and on its own contributed to a 49 percentage point 28 percent reduction in child poverty compared to what the monthly poverty rate in October would have been in its absence. The monthly child tax credit payments have come to an end but more money is coming next year.

The credit is 3600 annually for children. This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families. For example the maximum monthly payment for a family that received its first payment in October is 500-per-child for kids ages 6 through 17.

Heres what to know including when and where itll be deposited. The October installment of the advanced child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail on Friday. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October.

First families can expect some treats since the fourth round of advance monthly payments for the child tax credit are. The actual time the check arrives depends on the payment method and. IRS issues October child tax credits gives update on delayed payments.

October 29 2021. Ad The new advance Child Tax Credit is based on your previously filed tax return. The advance is 50 of your child tax credit with the rest claimed on next years return.

In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. But many parents want to know when. These payments are advances.

Octobers child tax credit monthly check will go out to eligible families on Friday Oct. CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow. The American Rescue Plan which was signed into law on March 11 2022 expanded the Child Tax Credit which meant.

October 14 2021 259 PM CBS Los Angeles. How Much Will I Receive For My October Child Tax Credit Payment. The October installment marks the fourth of sixth monthly payments of the advance tax credit with the last two set to be issued on Nov.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Typically you can expect to receive up to 300 per child under age of 6 250 per child ages 6 to 17. Taxpayers can claim the last half of the.

The payments are part of the American Rescue Plan a 19 trillion package that expanded the child tax credit temporarily for 2021 which President Joe Biden signed into law in March. As part of the continuing process of building out the advance CTC program which has included outreach to bring in previous non-filers and the launch of the CTC Update Portal that has allowed millions of. 2 days agoThe vast majority of low-income families used the child tax credit payments for necessities such as food clothing rent and utilities according to.

The child tax credit was expanded for one year under the American Rescue Plan Act of 2021 ARPThe ARP increased the credit to 3600 per child under the age of 6 and 3000 per child between the ages of 6 and 17 note also that it increased the maximum age for. These amounts were paid out on the 15th of the month from July to December with a final Child Tax Credit payment to come in April of 2022. The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of age.

CBS Detroit --The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15. Start the day smarter. Down at the bottom of the post the Facebook user writes.

The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. Get all the news you need in your inbox each morning. These credits can be.

IR-2021-201 October 15 2021.

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Child Tax Credit Will There Be Another Check In April 2022 Marca

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Americans Should Be Prepared For A Smaller Tax Refund Next Year

Child Tax Credit What The New Monthly Checks Mean For Your Family Npr

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit Schedule 8812 H R Block

Ontario Trillium Benefit Otb 2022 Loans Canada

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada